san antonio tax rate for cars

This is the total of state county and city sales tax rates. San antonio tax rate for cars Sunday March 13 2022 Edit.

/do0bihdskp9dy.cloudfront.net/08-16-2022/t_e8617d23ba96468083a48b9904608c86_name_file_1280x720_2000_v3_1_.jpg)

Proposed Tax Rate Decrease In Waco

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

. Stop by one of our branches today and see why our members rave about our superior service and the ability to help meet your financial. It is also used to calculate use tax on motor vehicles brought into Texas that were purchased from a private-party out of state. San Antonio Food Bank Fighting Hunger Feeding Hope Sc Allows Over 2000cc Diesel Vehicles In Delhi Imposes 1 New Tax The.

San Antonios current sales tax rate is 8250 and is distributed as follows. The City of San Antonios Hotel Occupancy Tax rate is 9 percent comprised of a 7 percent general occupancy tax and an additional 2 percent for the Convention. Object moved to here.

Please note that there may be different tax percentages depending on the. San Antonios current sales tax rate is 8250 and is distributed as follows. Jurors parking at the garage.

When visiting downtown San Antonio for Bexar County offices we recommend the Bexar County Parking Garage. 0125 dedicated to the City of San Antonio Ready to Work. 1000 City of San Antonio.

Tax info is updated from httpscomptrollertexasgovtaxessalescityphp and dated April 1 2022. Texas collects a 625 state sales. The Texas sales tax rate is currently.

Motor vehicle sales tax is due on each retail sale of a motor vehicle in Texas. Graduated rates starting as low as 15 apply to income of a corporation with total taxable. The base San Antonio Texas sales tax rate is 125 the San Antonio MTA Transit tax is 05 and the San Antonio ATD Transit rate is 025 so when combined with the Texas sales tax rate of.

The sales tax jurisdiction. Rates will vary and will be posted upon arrival. San antonios current sales tax rate is 8250 and is distributed as follows.

Greater Texas Credit Union serves the San Antonio area with some of the lowest rates in Texas on new cars used cars and even refinancing an existing auto loan. For more information please see Private-Party Purchases and. The average cumulative sales tax rate in San Antonio Texas is 823 with a range that spans from 675 to 825.

Sales and Use Tax. In addition to taxes car purchases in. This includes the rates on the state county city and special levels.

When is we can survive 2022. There is no applicable county tax. 9 city staff first proposed a preliminary tax rate of 4999 cents per 100 of the appraised value below the current 5121-cent tax rate.

Cares check implications stimulus Edit. Car Tax Rate Tools. San Antonio Fast and.

San Antonios current sales tax rate is 8250 and is distributed as follows. In addition to interest delinquent taxes incur the following. Texas collects a 625 state.

Car Loan Rates as low as 424 APR in San Antonio. Texas collects a 625 state sales tax rate. San Antonio in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in San Antonio totaling 2.

The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax. The County sales tax. A delinquent tax incurs interest at the rate of 1 for the first month and an additional 1 for each month the tax remains delinquent.

The minimum combined 2022 sales tax rate for San Antonio Texas is. A used car in Texas will cost 90 to 95 for title and license plus 625 sales tax of the purchase price.

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Irs Announces Inflation Adjustments For Tax Rates In 2023 The New York Times

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

San Antonio Area Budgets Offer Tax Relief Utility Credits Community Impact

Byrider San Antonio South Home Facebook

San Antonio Council Weighs Property Tax Relief Proposals Community Impact

Mayor Nirenberg Says He Ll Support A Homestead Exemption Without Upping Tax Rates To Offset It San Antonio News San Antonio San Antonio Current

State Legislature Forces School Boards To Lower Property Tax Rates Texas Scorecard

Paycheck Calculator For 100 000 Salary What Is My Take Home Pay

Used Cars In San Antonio Tx For Sale Enterprise Car Sales

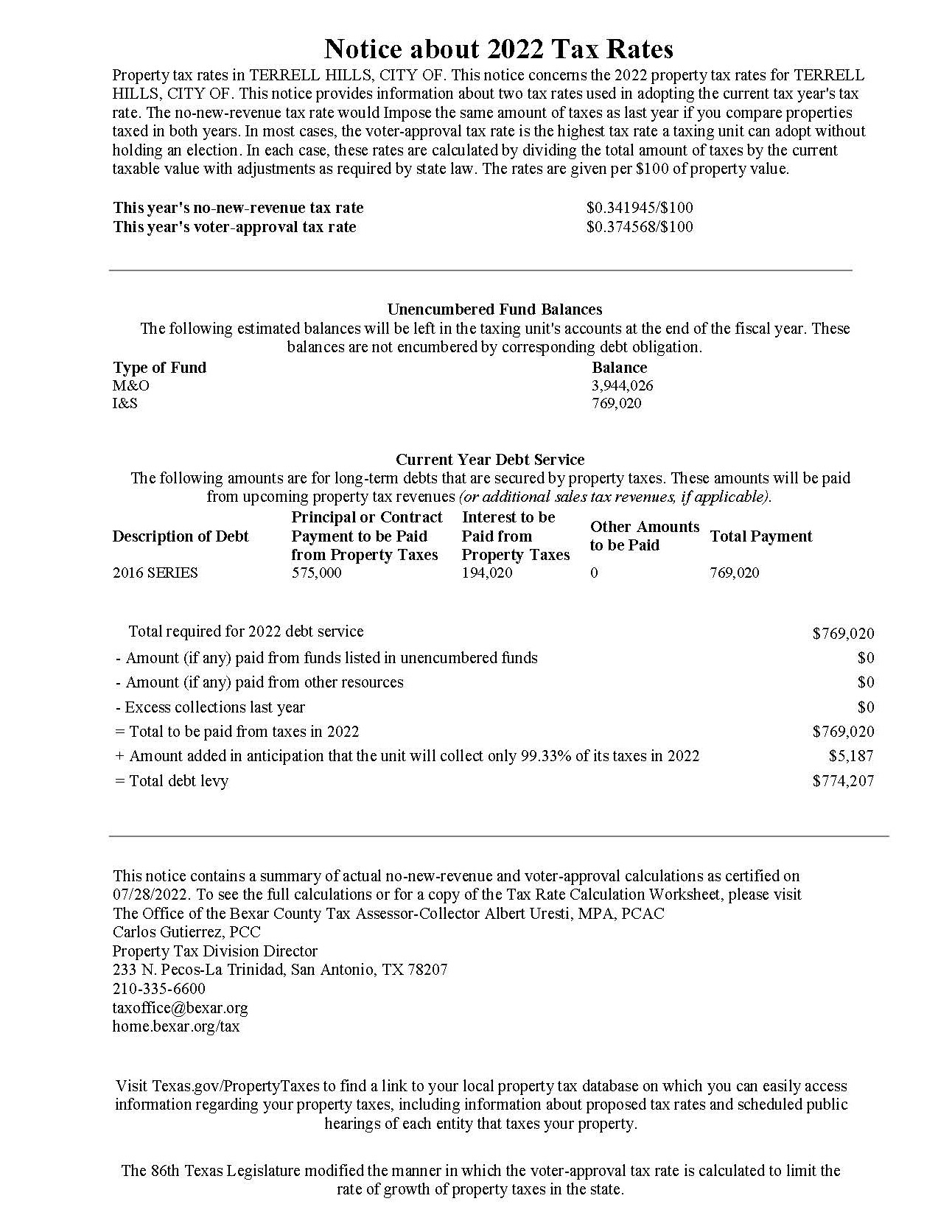

Tax Rates Bexar County Tx Official Website

Bexar County Cities Ranked By Property Tax Rate Total During 2016 San Antonio Business Journal

Used Car Dealership In San Antonio Tx 78233 Buy Here Pay Here Byrider

A Complete Guide On Car Sales Tax By State Shift

Tax Rates And Local Exemptions Across Texas San Antonio Report

Used Cars For Sale Buy Here Pay Here San Antonio Tx 78233 Byrider